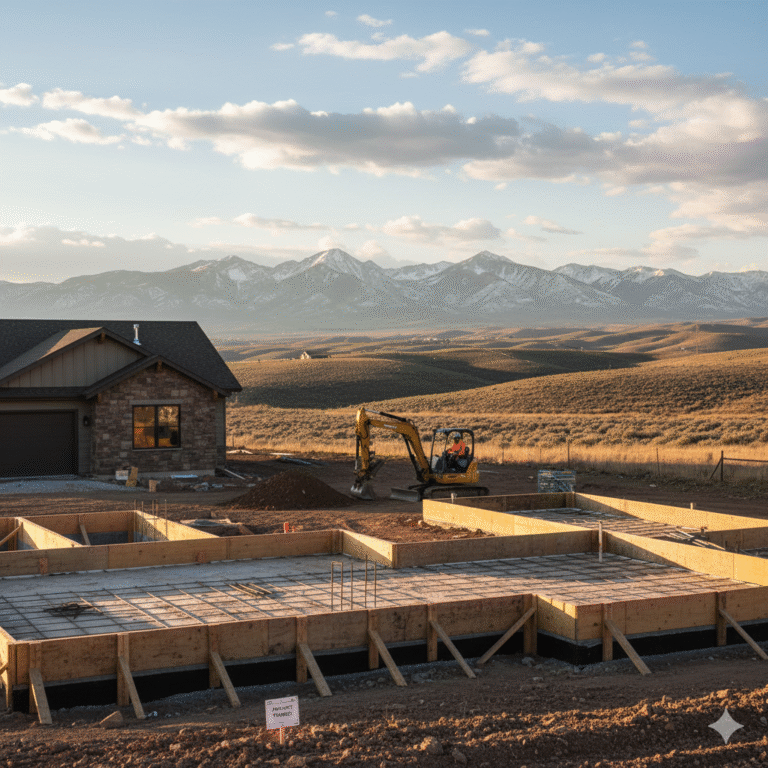

Building a home is one of the most exciting experiences in life, but it can also be a significant financial challenge. For residents in Utah, using a USDA construction loan can make building a home easier, especially in rural areas. A well-planned budget helps you manage costs, avoid overspending, and ensures that your dream home becomes a reality without financial stress. In this guide, we will explain how to plan your home construction budget wisely while taking advantage of a USDA construction loan in Utah.

Why a Construction Budget Matters

Before starting construction, it’s important to understand the role of a budget. A construction budget acts as a roadmap for your project, giving you a clear picture of total costs, including materials, labor, permits, and unexpected expenses. For homeowners in Utah, a USDA home construction loan can cover a significant portion of these costs, especially in eligible rural areas. Planning your budget wisely helps you make informed decisions about your home’s design, materials, and features while staying within your financial limits.

Assessing Your Financial Situation

The first step in planning a construction budget is evaluating your finances. This involves reviewing savings, income, and existing debts. If you are considering a USDA construction loan in Utah, you should also research USDA eligibility requirements, including income limits and property location. Knowing how much you can comfortably allocate to your home project ensures that you avoid overextending yourself. Proper financial planning is key to a smooth construction process.

Estimating Construction Costs in Utah

After assessing your finances, the next step is estimating construction costs. Construction expenses vary depending on location, design complexity, materials, and labor rates. In Utah, construction costs can differ between urban and rural areas. Start by researching the average cost per square foot and multiply it by the size of your planned home. Keep in mind that choosing high-quality materials or custom designs will increase the overall cost. Using a USDA building loan in Utah can help cover these expenses while keeping your upfront investment low.

Accounting for All Expenses

A common mistake is overlooking certain expenses. Beyond materials and labor, there are permits, inspections, utility connections, landscaping, and furniture to consider. Construction projects often face unforeseen issues like delays or sudden price increases. By including a contingency fund in your budget, you can handle unexpected costs without stress. Many homeowners in Utah use USDA construction loans because they provide structured funding that helps cover both planned and unexpected expenses during the building phase.

Prioritizing Your Needs and Wants

When planning a budget, it is essential to separate needs from wants. Needs include essential aspects of the home such as plumbing, roofing, electrical work, and structural integrity. Wants are features like luxury flooring, custom cabinetry, or smart home systems. By identifying priorities, you can allocate funds effectively, ensuring your home remains functional even if you need to scale back on some non-essential features. Using a USDA construction loan in Utah gives you flexibility in managing these choices, since the loan can cover essential construction costs while you plan upgrades for the future.

Working with Professionals

Hiring experienced professionals like architects, contractors, and financial advisors can greatly improve your budgeting accuracy. Architects help design cost-efficient homes that meet your needs. Contractors provide realistic labor and material estimates, while financial advisors can guide you on USDA home loan options in Utah. Working with professionals reduces the risk of costly mistakes and ensures that your budget aligns with your home’s construction requirements.

Monitoring Your Budget During Construction

Even with careful planning, a budget should be monitored throughout the construction process. Keep track of all expenses and compare them with your initial estimates. Communicating regularly with your contractor ensures that any changes are addressed promptly. Adjustments may be necessary if material prices rise or unexpected issues occur, but staying proactive helps avoid overspending. Homeowners using USDA construction loans in Utah often find this monitoring process easier, as disbursements are tied to construction milestones, ensuring funds are available when needed.

Financing Options for Home Construction

For many homeowners, financing is a crucial part of budgeting. While savings can cover part of the cost, loans often bridge the gap. USDA construction loans in Utah are particularly helpful for rural properties, offering low interest rates and no down payment requirements. Other options include conventional construction loans or personal loans. Choosing the right financing method ensures that you have sufficient funds throughout the building process while maintaining financial stability.

Considering Long-Term Costs

A well-planned budget also accounts for long-term costs. Energy-efficient materials, proper insulation, and sustainable systems may have higher initial costs but can reduce utility bills over time. Additionally, homeowners should consider maintenance, property taxes, and insurance when planning their budget. By using a USDA construction loan in Utah, you can cover construction costs upfront while preparing for these long-term financial obligations. This ensures a complete picture of your home investment.

Conclusion

Planning a home construction budget wisely is essential for building your dream home without financial stress. For Utah residents, using a USDA construction loan can make the process more manageable, especially in rural areas. By understanding your finances, estimating costs, accounting for all expenses, prioritizing needs, working with professionals, monitoring the budget, and planning for long-term costs, you can achieve a successful construction project. Careful budget planning combined with a USDA construction loan ensures your dream home becomes a reality while keeping your finances secure.